Every marketer wants to know if their ad spend is working. ROAS (Return on Ad Spend) provides a quick snapshot by showing how much money you earn for every dollar spent on ads. This makes it an essential tool for budget allocation and campaign comparison. That’s why ROAS calculation is essential to assess your advertising campaigns!

What Is ROAS?

ROAS, or Return on Ad Spend, shows how much revenue you earn for every dollar spent on advertising. It’s a simple way to measure if your ads are paying off.

Calculating ROAS is important because it helps you decide where to invest your ad budget. By comparing campaigns, platforms, or even individual ads, you can quickly see which ones bring the best returns. The main benefit is clarity: it’s straightforward, easy to calculate, and useful for short-term budget decisions.

However, ROAS has its limits. It doesn’t account for other costs like staff, shipping, or fees, which can eat into profit. That’s why relying only on ROAS can be misleading. To get a full view of marketing performance, pair ROAS with other metrics like ROI, conversion rate, and customer lifetime value. This balanced approach helps ensure smart, long-term growth.

How To Calculate ROAS?

The ROAS Formula

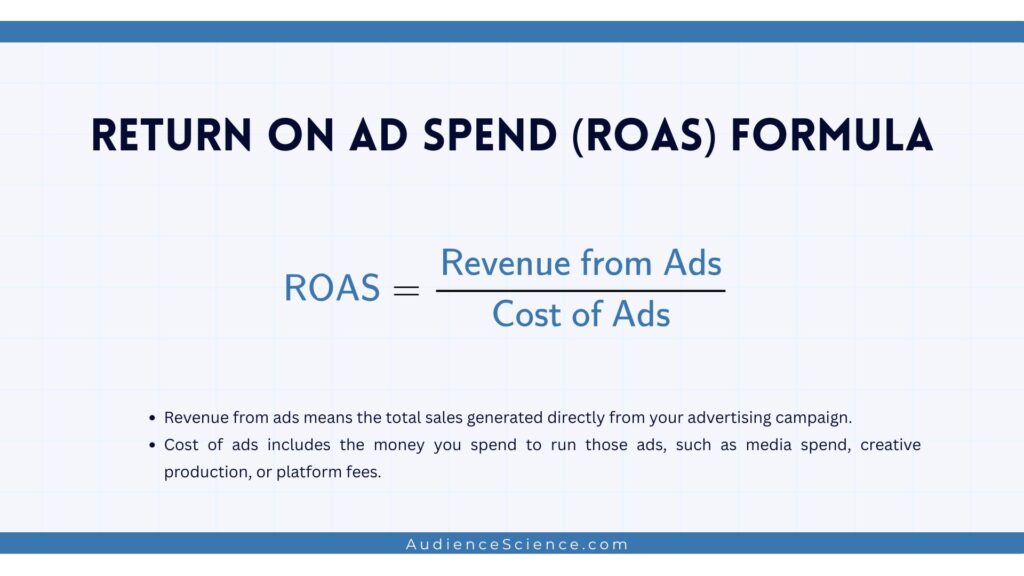

The formula for ROAS is simple:

ROAS = Revenue from Ads / Cost of Ads

Here:

- Revenue from ads means the total sales generated directly from your advertising campaign.

- Cost of ads includes the money you spend to run those ads, such as media spend, creative production, or platform fees.

The result tells you how much money you earned for every dollar invested in advertising. For example, a ROAS of 5 means you earned $5 in revenue for every $1 spent.

ROAS Calculator

Break-Even ROAS Calculation Formula

Break-even ROAS is the minimum return on ad spend you need to avoid losing money. At this point, your advertising revenue exactly covers your costs – no profit, no loss.

Knowing this number is important because it sets the baseline for your campaigns. Without it, you might keep running ads that generate sales but still hurt your bottom line. If your ROAS falls below the break-even level, your ads are costing you more than they’re earning. If it’s higher, you’re moving into profit.

The formula is straightforward but requires knowing your average profit margin percentage:

Step 1.

Average Profit Margin = Average Order Value – Average Order Cost

Step 2.

Average Profit Margin % = (Average Profit Margin / Average Order Value) × 100

Step 3.

Break-even ROAS = 1 / Average Profit Margin %

For example, if your average profit margin is 40%, your break-even ROAS is 1 ÷ 0.40 = 2.5 (or 250%). This means your ads must generate at least 250% ROAS to cover costs. Anything above that is profit.

Example

Imagine you spend $2,000 on ads and earn $10,000 in revenue.

ROAS = $10,000 ÷ $2,000 = 5 (or 500%)

Now, if your average profit margin is 25%, then:

Break-even ROAS = 1 ÷ 0.25 = 4 (or 400%)

Since your ROAS is 500%, you are above the break-even point (400%) and making a profit.

FAQs

What is a good ROAS?

A “good” ROAS depends on profit margins and costs. Classy Llama notes that anything under 400% often still loses money, while 400–799% may break even. Profitability is more consistent above 800%, with 900% as a minimum goal and 1,200%+ ideal. Always check margins and ROI first to set the right ROAS target.

What affects ROAS?

Several factors can raise or lower your ROAS:

- Targeting: The closer your ads reach the right audience, the better. Wrong targeting wastes ad spend.

- Keywords: Short-tail keywords are costly and broad; long-tail keywords are cheaper and often drive better conversions.

- Cost per Click (CPC): Too high eats your budget, too low may not reach enough people.

- Landing pages: Poor design, unclear calls to action, or missing product info lower conversions.

- Additional costs: Vendor fees, affiliate commissions, and transaction costs all reduce your real return.

How do ROAS and ROI differ? Which one should I use?

ROAS focuses only on advertising efficiency. It tells you how much revenue you earn for every dollar spent on ads. This makes it a quick, clear way to compare campaigns, platforms, or ad strategies.

ROI, on the other hand, is broader. It considers all business costs such as product manufacturing, salaries, shipping, and overhead. ROI answers the bigger question: Is the entire investment, not just the ads, profitable?

If your goal is to decide where to allocate ad budgets in the short term, use ROAS. If you want to measure overall business profitability and long-term success, use ROI. Ideally, track both to balance tactical ad decisions with strategic financial insights.

See more marketing calculator tools: